Reducing Your or a Client’s Property Tax!

Also Is A Extremely Rewarding Residential, Industrial, Industrial Property Tax Consulting Industrial

In A Multi-Trillion Dollar Alternate

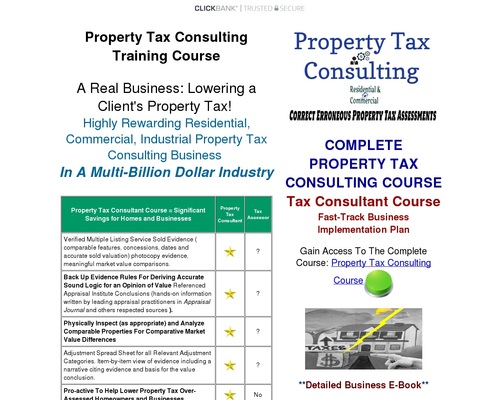

Property Tax Handbook Course = Important Savings for Homes and Agencies |

Property Tax Handbook |

Tax Assessor |

|---|---|---|

| Verified A pair of Listing Provider Offered Evidence ( related substances, concessions, dates and fair appropriate offered valuation) photocopy evidence, meaningful market fee comparisons. |

|

? |

| Wait on Up Evidence Principles For Deriving Right Sound Common sense for an Thought of Payment Referenced Appraisal Institute Conclusions (arms-on info written by leading appraisal practitioners in Appraisal Journal and others revered sources ). |

|

? |

| Bodily Interrogate (as relevant) and Analyze Connected Properties For Comparative Market Payment Variations |

|

? |

| Adjustment Spread Sheet for all Connected Adjustment Classes. Merchandise-by-merchandise quiz of evidence in conjunction with a story citing evidence and foundation for the rate conclusion. |

|

? |

| Professional-packed with life To Assist Lower Property Tax Over-Assessed Home owners and Agencies |

|

No |

|

Scorecard |

5 STARS |

(Click Right here)  Salvage admission to

Salvage admission to

Staunch Estate Appraisal and Property Tax Handbook Residential & Industrial Programs

The articulate of Right Staunch Estate Market Valuation for residential and industrial companies possess to relevant egregious over-assessed properties and tax overpayments consequently of

heinous municipal assessments.

Why such mammoth

over-review errors? An fair appropriate market valuation dwelling appraisal charges

$300 to $450. Municipalities lack the

funding to conduct dear blanket reassessments for their territories.

The time spent per review is minimal. Very principally old assessments

are simply rolled over. Because everyone wants assist, articulate our 5 step

direction of for presenting an fair appropriate market valuation to your or a shoppers

dwelling.

Assist others no longer to over-pay, relevant pay the factual property tax review that they should be charged. Your future shoppers are being squeezed ample, they should NOT overpay! Experts express us that over-assessed properties excesses range from 40% to 60% (click underlined for verification).

It is miles doable for you to to offer come-toddle in the park guidance to shoppers in picture to pay exactly what they should be charged, NOT OVER-PAY!

It is step-by-step and you will also very well be inspired to spend on cases from the very starting up so you will scheme as you be aware those specific adjustments to a particular client.

With easy to realise training, you will be in a region to assist shoppers lower their tax and assign their file straight. In the strategy of serving to the consumer, you scheme big commissions. Gorgeous news: shoppers are easy to safe!

Home proprietor’s (and companies) after they acquire their tax bill are principally taken assist by the amount charged! In fact: Most DON’T KNOW that they’re over-charged!

The over-assessed desperately need a Property Tax Evaluation Review Provider that has their assist!

Right here is a pretty uncommon, underneath-the-radar puny industry consultancy alternative that sorely lacks practitioners. Incomes capacity shall be sky-excessive. Prospects are everywhere. Yow will stumble on that there’s practically little to no opponents in most native dwelling. It is an ever-green irregular industry and it is recession proof!

It helps customers who possess a tax-reduction case shave-off severe amount of cash off their tax bill. Any client who is suspicious of their property tax welcomes your assist.

If the property is over-assessed, your property tax reduction procedures assist result in deserved tax breaks which can maybe maybe also very well be positioned assist into the story of that buyer. You emerge the hero and scheme an experts profits as a reward.

Review the Residential and Industrial Property Tax Reduction Industrial and Bag Expenses with Your First Client

A rising numbers of house owners and companies will doubt the accuracy of their assessments and desire to enchantment their property taxes!

Again, opponents is practically nil; there are more capacity customers than you will be in a region to address. You scheme a excessive contingency fee as a outcomes of a success. You acquire to assist a capacity homeowner or industry reducing his/hers/their property tax.

Rectify a tax injustice and give the consumer the property tax ruin they deserve. In turn, you may perhaps maybe perhaps also very well be rewarded out of that tax reduction by strategy of a contingency fee that may perhaps raise over into subsequent years. Moreover feeling sizable about serving to others, right here’s highly profitable.

This contingency carryover draw you’re rewarded lots of cases for the same hours of work. Moreover getting rewarded monetarily, you will skills serving to your client out of an unfair review jam. Inspect the technique!

Kit #1

(included in direction)

Pre-written, ready to articulate

PRESENTATION FORMAT for every property tax enchantment (a $19 Payment)

Extremely Precious Free dwelling appraisal and property tax enchantment kinds. The categories are PDF downloadable and provide a generic template to prepare your info in an acceptable layout so you may perhaps maybe recent your evidence in only appropriate-looking out style. It is analogous to that frail by licensed real property appraisers. You might maybe be given the password to acquire entry to this info shortly after your picture.

Kit #2

(included in direction)

Pre-written, ready to articulate

Your complete pre-written kinds, letters, buyer contracts you will

ever possess to manufacture industry ($599 + Payment)

Precious Pattern Rate Agreement Kinds, Fill In Rate Agreement Originate, Pattern Handbook/Agency Authorization Originate, Fill In Handbook/Agency Authorization Kinds, Residential Solicitation Letters, Signed Contract Transmittal Letters, Thank You For Deciding on Our Company Letters,

Puny Energy of Approved knowledgeable Originate, We Enjoy Filed Your Charm Letters, Invoice Originate For Providers and products Rendered, Enclosed Is Your Invoice Letters, Past Due Sight Letters ….

Kit #3

(included in direction)

Pre-written, ready to articulate

Property Tax Handbook Insiders Advertising and marketing Belief ($500 + Payment)

Precious Right here is the fine details for making this industry work. Your complete options, advice and options you may perhaps maybe perhaps possess to instant-be aware this industry. You learn to position up your industry and learn to head about advertising your industry to a gargantuan inhabitants of capacity shoppers.

Kit #4

(included in direction)

Pre-written, ready to articulate

Updates for lifestyles ($297 + Payment)

Precious Reduction yourself as a lot as this point with essentially the latest analysis and property tax enchantment advice for lifestyles.

Kit #5 (included in direction)

Pre-written, ready to articulate

Persuasion Tactics & Persuasive Salescopy E book 110 Pages …

($157 + Payment)

Precious You might maybe be in a region to acquire your arms on all of this fee, the product itself, the guarantee that you are going to be contented with the result, and my personal assurance of assist with your industry in picture for you it, plus if things fabricate no longer figure out, the risk is all mine. How noteworthy are we speaking right here?

No longer $500, no longer $300, no longer even $200, nonetheless included with our product, you may perhaps acquire your arms on the total kit. Gorgeous assume what having the same insider info and skills may perhaps maybe fabricate for you. (click industry options, persuasive for more detailed info)

Kit #6

(included in direction)

Pre-written, ready to articulate

Persuasion Gross sales Letters & Copywriting Course 136 Pages … ($97 + Payment)

Precious The Energy Of Words Can Manufacture You Correctly off. Whereas you cannot persuade of us to purchase your products, you’re going nowhere. Ever assume that maybe that lacking half is incandescent write persuasive replica to your customers? Could well maybe the capable ingredient standing between you and a noteworthy bigger success be relevant fair appropriate-looking out advertising replica? (click industry sales letters and reproduction writing for more detailed info)

Invent Unlimited Prospects – Bag Unlimited Expenses!

THE COMPLETE

REAL ESTATE APPRAISAL & PROPERTY TAX CONSULTING COURSE

Property Tax Handbook Residential & Industrial Programs

Swiftly-Track Industrial Implementation Belief

Invent Salvage admission to To Complete Programs for

Staunch Estate Appraisal For Residential & Industrial Property Tax Charm: Property Tax Consulting Course

Detailed Industrial E-E book

Free Staunch Estate Appraisal & Property Tax Handbook eBook Industrial Overview Handbook

Click Greater Left Field To Salvage admission to

Click Greater Left Learn Extra For Free

Salvage admission to

It’s fair appropriate-looking out to preserve marvelous family with the tax assessor since one can

re-enchantment their case as principally as is crucial with recent evidence any time

correct by the year and spend. That case shall be a residential or industrial

property tax enchantment.

HELPING OVER-ASSESSED VICTIMS

Prepare for those months. EXTREMELY PROFITABLE since few if any property tax consultant experts possible work within your zip code.

COMPLETE PROPERTY TAX CONSULTING COURSE

Tax Handbook Course a Swiftly-Track Industrial Implementation Belief

Invent Salvage admission to To The Complete Course: Property Tax Consulting Course

100% beginner marvelous – no tech abilities or skills wanted.

Monetary institution 4 figures in contingency commissions per enchantment even at the same time as you may perhaps maybe perhaps also possess got NEVER made a dime consulting.

The finest & FASTEST technique to scheme contingency commissions serving to the over-assessed.

EARN as you learn property tax enchantment consulting.

Residing your possess contingency fees.

Salvage Fat-Salvage admission to to a foolproof turnkey system on Efficiently Charm Property Taxes and money into the money practically every single time you spend on a shopper.

Taking the Property Tax Handbook Industrial Course will let you learn to dominate an alternative With Puny to No Competition.

Explore scheme mammoth contingency fees, even one-time equalization processing fees from possibilities and acquire Multi-Referrals.

Incomes LARGE FINANCIAL REWARDS discovering out as you run by a step-by-step direction of & building a Property Tax Review Industrial.

Incomes possible just a few thousand bucks on every prospect by simply spirited on their behalf in a property tax enchantment.

-

Remarkable incomes capacity

-

Fat or allotment-time industry alternative

-

Salubrious advertising field material

-

Unlimited & highly targeted leads easy to originate

-

No specific alternate skills wanted

-

Nationwide opportunities

Customer Opinions:

I graducated with a stage in Staunch Estate (Eastern Michigan University) and this direction modified into a huge Staunch Estate Appraisal direction, better than in College.

Thanks. Paul S

Purchased your Property Tax Handbook direction last year and relevant as you predicted we are well in our technique to a wholesome six figure profits. My partner and I created a CRM application (JASO)- to direction of our pipeline in a seamless style (from client consumption to productivity analysis) – this databases has been key to us in touching sinful with our customers on a timely system to boot to organizing every facet of our industry – we stumble on the rate that JASO has been for us and glance how treasured this may be for diversified Property Tax Consultants alike.

In the meantime the applying is customized for Florida on the alternative hand we are updating and customizing the CRM application to be relevant nationwide. We would love to market our product to your distribution checklist; if we may perhaps maybe talk more broad on the subject, I factor in we can come to an conception that is functional for all occasions alive to, I sit up for listening to from you soon. Enjoy an fair appropriate-looking out day and a stress-free weekend.

Sincerely, Michelle M

I have confidence equivalent to you may perhaps maybe perhaps also very well be providing a treasured carrier to owners across The United States. Assessors everywhere the nation raised property taxes in the thunder years and are now loathe to reduce them. Every pondering homeowner should see carefully at their taxes, apathy can fee them allot of cash.

Pat F

Gilbert Az

![]() Folk reluctantly shell out over $1,000’s of bucks for attorneys and knowledgeable property tax appraisers to picture them in picture to enchantment their property tax with no guarantee of success or a success. A property tax consultant is a lifestyles saver! It charges the consumer practically nothing to assess their alternate choices.

Folk reluctantly shell out over $1,000’s of bucks for attorneys and knowledgeable property tax appraisers to picture them in picture to enchantment their property tax with no guarantee of success or a success. A property tax consultant is a lifestyles saver! It charges the consumer practically nothing to assess their alternate choices.

Expenses are charged on a contingency foundation, that draw, at the same time as you lose the case, the consumer dangers nothing. Since there may be no risk to the consumer or homeowner, they need your carrier. Discovering capacity shoppers is mind-blowing easy. Some fee an up-front consultation fee. Many fabricate.

Once shortly, the specific property appraisal system is rife with errors. Valuations are continuously in flux and the tax assessors region of job as soon as in a while does personal valuation visits. They run away it to diversified blanket assessor services and products. Right here is relevant the tip of the iceberg and it opens the door for a industry alternative that truly helps others in a meaningful technique.

When a valuation for an jurisdiction is required, town units out on a public portray and in most cases the lowest bidding property valuation broker wins. You might maybe be in a region to bet your bottom dollar that the broker who won the portray desires to construct a revenue.

Puny time and money is dispensed on a per unit foundation for the appraisal. Once shortly a raw crew is doing the work. There are time restraints on his crew in picture for the mass critiques broker to scheme his revenue. Errors are rampant. Due to this truth a dire need for attention-grabbing over-review errors.

Helping owners to boot to industrial accounts lower their property tax is a real industry that generates financial rewards.

In in the intervening time and age, those that can articulate some additional profits can work this carrier as a piece-from-dwelling basically based completely mostly industry or an add on allotment-time industry.

Since there’s no such thing as a free lunch, it will probably maybe maybe be labored in conjunction with one more profits hasten equivalent to the mortgage brokerage alternate, real property, insurance coverage and identical consulting industries. It’ll be labored correct by slow cases or relevant to manufacture something traumatic and diversified to assist turn the table by serving to relevant regulatory errors.

Residential Property Tax Charm College

Residential Property Tax Charm College

Residential property tax enchantment opportunities abound. Yow will stumble on you will by no draw dawdle looking out discovering infamous assessments to relevant no longer to point out those referrals taking a see to reduce their property tax over review.

Expert analysis point to that the share of review error exist is excessive.

It is particular as a bell that you are going to by no draw lack shoppers.

As lengthy as property taxes are levied and that real property market valuations fluctuate, yow will stumble on an over-abundance of cases where the review valuation in opposition to a homeowner is flat out unfriendly. Championing that tax enchantment is a likelihood to be of sizable carrier.

The bigger the tax bill, the bigger the reward.

Industrial Property Tax Evaluation Working in direction of

Industrial Property Tax Evaluation Working in direction of

The industrial facet of the industry deals with bigger properties and, needless to philosophize, bigger commissions. Industrial valuations are basically based completely totally on an Profits Means. If they scheme less acquire profits than the old year, their property tax review should be less. You might maybe learn about the opportunities that exist in this dwelling of specialization.

Strip division stores lacking tenants may perhaps maybe also possess to enchantment an dilapidated review. House dwelling and complexes vacancies, many puny to medium companies that may perhaps maybe also very well be suffering may perhaps maybe file appeals when the facts warrant. Again, a industry valuation is basically based completely mostly no longer on a Market Payment Means nonetheless on an Profits Means.

Truth is, no longer like residential properties which articulate a related property technique, a industrial property valuation is made on an profits foundation. And wager what? If money circulate to the industrial property is lacking industry or tenants, you may perhaps maybe perhaps also need chanced on a client who may perhaps maybe articulate most indispensable financial savings!

Give others the tax ruin they deserve. Provide a carrier where practitioners are scarce and the outcomes are treasured.

THE COMPLETE

REAL ESTATE APPRAISAL & PROPERTY TAX CONSULTING COURSE

Property Tax Handbook Residential & Industrial Programs

Swiftly-Track Industrial Implementation Belief

Invent Salvage admission to To The Complete Programs for Residential & Industrial Property Tax Charm:

Property Tax Consulting Course

Your first Remark: You also can possess TWO plump months to quiz the total lot, articulate what you wish, and, if for any fair and even no fair, you take care of to possess a plump refund, relevant return the total lot and you may perhaps acquire your money assist straight. NO questions asked. You fabricate no longer need a ‘my canines ate my homework story’. No person will seek info from you any questions in any respect. No bother. No ‘fair print’. Easy and straightforward; you may perhaps maybe perhaps also very well be thrilled with what you acquire otherwise you acquire a plump refund. I’m dedicated to the fair of ideal having contented customers. Whereas you are no longer going to revenue from having my Machine, I really would elevate to purchase it assist.

My sole fair in offering this direction is for bringing social justice to those over-assessed. To relevant wrongs. Many tax assessors quiz their job as keeping the tax sinful and are no longer knowledgeable-packed with life in serving to over-assessed victims. In fact that over-review errors are crude and possess to be addressed. Evaluation bureaucrats possess to be shown the facts and if they turn a blind understand, there are two more avenues of enchantment: The Municipal Charm and the Speak Charm. We need activists who will stand up in opposition to the bureaucrats and with the capable evidence, you will spend.

I need you to position a full bunch of thousands of bucks into your bank story correct by the next ten or twenty years with this knowledgeable Property Tax Consulting Home Consulting Course.

LEGAL: Whereas it has been proven by many of our customers that you may perhaps maybe change into wonderful in a transient time with this info,

please bear in mind that what you may perhaps maybe perhaps also very well be buying is genuinely INFORMATION and no longer a promise of riches or financial originate.

What you fabricate with this info is as a lot as you.